Explore web search results related to this domain and discover relevant information.

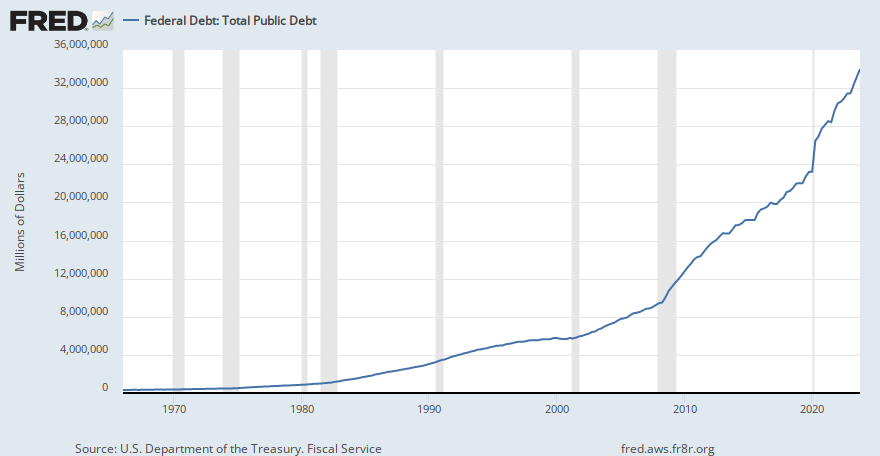

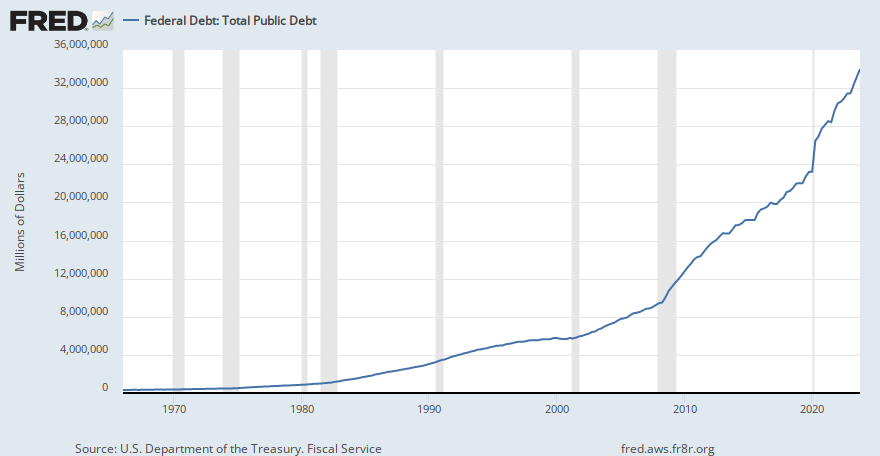

The national debt already exceeds $36 trillion and is growing at historic rates. That has cascading consequences for the government and economy.

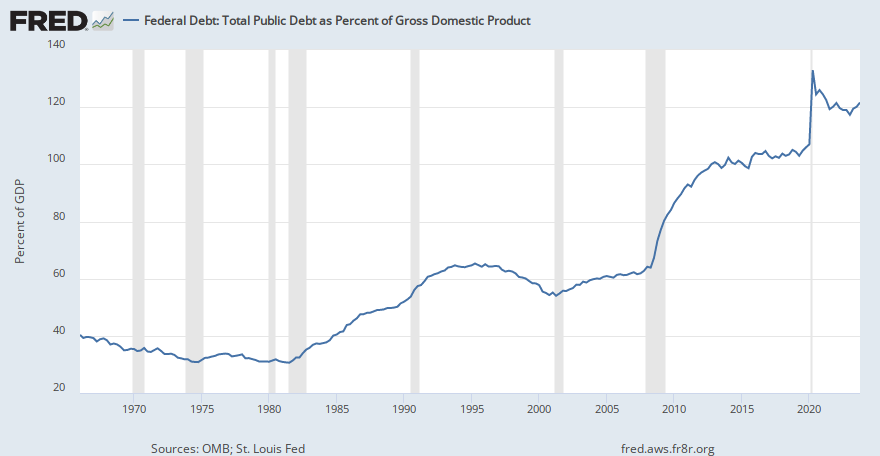

The U.S. owes lenders more than $36 trillion. That is close to an all-time high when comparing the debt to the country’s total economic output — a leading indicator of the nation’s ability to pay it all back.The federal government is taking on record amounts of debt year after year.

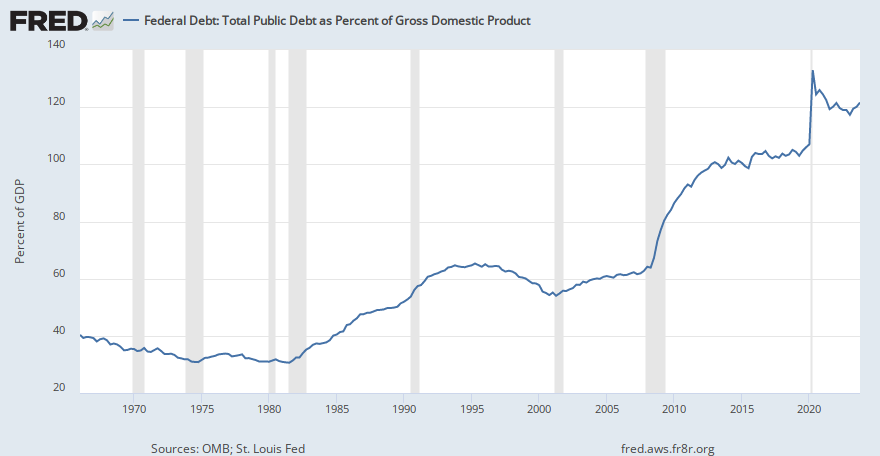

Graph and download economic data for Federal Debt: Total Public Debt (GFDEBTN) from Q1 1966 to Q2 2025 about public, debt, federal, government, and USA.

U.S. Department of the Treasury. Fiscal Service, Federal Debt: Total Public Debt [GFDEBTN], retrieved from FRED, Federal Reserve Bank of St.U.S. Treasury: Financial Management Service Public Debt Federal Government Quarterly Nation Public Domain: Citation Requested Not Seasonally Adjusted United States of AmericaFederal Debt: Total Public Debt as Percent of Gross Domestic Product

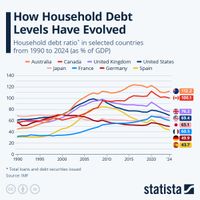

This chart shows the household debt ratio in selected countries from 1990 to 2022, as % of GDP.

According to the latest data from the International Monetary Fund (IMF), household debt in the United States amounted to 74.4 percent of GDP in 2022. This ratio is higher than several other major economies (between 50 and 55 percent in Spain and Germany, 66 percent in France and 68 percent in Japan).Over the past thirty years, the level of household debt in relation to GDP has risen considerably in developed countries. For all eight economies analyzed in the following infographic, the average debt-to-GDP ratio has risen from 51 percent in 1990 to 77 percent in 2022.Many industrialized countries, with the notable exception of Germany and Japan, experienced a sharp peak in household debt to GDP in the early 2000s. This excess of personal debt was one of the underlying causes of the global financial crisis of 2007-2008.In 2022, four countries had a household debt ratio in excess of 100 percent of GDP: Switzerland (128 percent), Australia (112 percent), South Korea (105 percent) and Canada (102 percent).

Reuters charts, maps and graphics

Learn how the national debt works and how it impacts you.

Check out @FiscalService Fiscal Data’s new national debt page! #NationalDebtThe national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time. In a given fiscal year (FY), when spending (ex. money for roadways) exceeds revenue (ex. money from federal income tax), a budget deficit results.To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities (TIPS). The national debt is the accumulation of this borrowing along with associated interest owed to the investors who purchased these securities.Decreases in federal revenue are largely due to either a decrease in tax rates or individuals or corporations making less money. The national debt enables the federal government to pay for important programs and services even if it does not have funds immediately available, often due to a decrease in revenue.

Our chart, compiled using IMF data on government debt, reveals stark differences between many leading economies.

UK chancellor Rachel Reeves remains under intense pressure to tackle mounting government debt.Getting debt on a downward path has been flagged as a priority for the government.The recent sharp selloff in government bonds – known as gilts in the UK – has pushed yields higher, further adding to the debt pile.More sustained action will be needed to truly tackle the debt pile though. And that's true for many other countries too, particularly in the wake of US president Donald Trump's tariff threats.

View the ratio of federal debt to the economic output of the U.S., which can indicate economic health and the sustainability of government borrowing.

It is calculated using Federal Government Debt: Total Public Debt (GFDEBTN) and Gross Domestic Product, 1 Decimal (GDP): GFDEGDQ188S = ((GFDEBTN/1000)/GDP)*100 GFDEBTN/1000 transforms GFDEBTN from millions of dollars to billions of dollars.U.S. Office of Management and Budget and Federal Reserve Bank of St. Louis, Federal Debt: Total Public Debt as Percent of Gross Domestic Product [GFDEGDQ188S], retrieved from FRED, Federal Reserve Bank of St.Federal Debt: Total Public Debt as Percent of Gross Domestic Product (GFDEGDQ188S) was first constructed by the Federal Reserve Bank of St. Louis in October 2012.U.S. Treasury: Financial Management Service Office of Management and Budget Public Debt Federal St.

The national debt is already at its highest level since just after World War II, and annual deficits are on an upward trajectory.

Unfortunately, America remains on an unsustainable fiscal path. Federal debt is already at its highest level since just after World War II and annual deficits are on an upward trajectory for the years to come. Every year, the federal government spends more than it takes in.As debt rises, so do interest costs, which can squeeze out investments in our shared future, like education, infrastructure, and research and development as well as spending on other federal programs that protect the most vulnerable Americans.Understand the U.S. national debt, why it matters, and what we can do.That fundamental mismatch between spending and revenues adds trillions to our national debt, weakening our economy and adding a burden on future generations.

Unique data and insight into the credit conditions and activity of U.S. households

HOUSEHOLD DEBT AND CREDIT · DATA BANK · CALENDAR · RESEARCHERS · ABOUT CMD · By continuing to use our site, you agree to our Terms of Use and Privacy Statement. You can learn more about how we use cookies by reviewing our Privacy Statement. · Request a Speaker ·Agency Debt Securities · Repos & Reverse Repos · Securities Lending · Discount Window · Treasury Debt Auctions & Buybacks as Fiscal Agent · INTERNATIONAL MARKET OPERATIONS · Foreign Exchange · Foreign Reserves Management · Central Bank Swap Arrangements ·

The United States national debt is over $37 trillion as of September 2025. This massive debt load equals more than $109,000 for every person in America. The government borrows money by selling Treasury securities to investors worldwide, creating obligations that must be repaid with interest.

The massive government spending required during the COVID-19 pandemic drove much of this surge. Debt held by the public represents direct claims on the nation’s economic output by external creditors, and interest paid on it flows from the Treasury to these investors.The debt grows daily as the government spends more than it collects in taxes.The U.S. Department of the Treasury’s “Debt to the Penny” dataset provides the most precise measure of total national debt at $37.41 trillion.With approximately 342.4 million Americans, the debt equals over $109,000 per person.

This infographic visualizes global government debt by country in 2025, highlighting debt-to-GDP ratios for 186 countries.

In 2025, public debt remains a pressing issue for many countries, with governments around the world are navigating fiscal challenges in the wake of the pandemic, geopolitical instability, and economic slowdowns.Typically, debt-to-GDP ratios balloon following periods of recessions or economic shocks, such as the 2008 Financial Crisis and the COVID-19 pandemic, when governments use fiscal stimulus to improve economic health.This infographic ranks countries by their debt-to-GDP ratio, a key metric used to assess how much debt a government holds relative to its economic output.Advanced economies are generally grappling with higher debt burdens than others, with an average debt-to-GDP ratio of 110%, compared to around 74% for emerging and developing economies.

The U.S. government’s gross national debt has surpassed $37 trillion, a record number that highlights the accelerating debt on America’s balance sheet and increased cost pressures on taxpayers

The national debt eclipsed $37 trillion years sooner than pre-pandemic projections. The Congressional Budget Office’s January 2020 projections had gross federal debt eclipsing $37 trillion after fiscal year 2030. But the debt grew faster than expected because of a multi-year COVID-19 pandemic starting in 2020 that shut down much of the U.S.And now, more government spending has been approved after Trump signed into law Republicans’ tax cut and spending legislation earlier this year. The law set to add $4.1 trillion to the national debt over the next decade, according to Congressional Budget Office estimates.Chair and CEO of the Peter G. Peterson Foundation, Michael Peterson said in a statement that government borrowing puts upward pressure on interest rates, “adding costs for everyone and reducing private sector investment. Within the federal budget, the debt crowds out important priorities and creates a damaging cycle of more borrowing, more interest costs, and even more borrowing.”The Government Accountability Office outlines some of the impacts of rising government debt on Americans — including higher borrowing costs for things like mortgages and cars, lower wages from businesses having less money available to invest, and more expensive goods and services.

US National Debt Clock : Real Time U.S. National Debt Clock : DOGE Clock

Data TypesAll data is returned as a string, including nulls. Refer to the chart above for the intended data type of each field. ... U.S. Treasury Monthly Statement of the Public Debt (MSPD)

Historical summary of the U.S. government’s total outstanding debt at the beginning of each fiscal year.Historical Debt Outstanding is a dataset that provides a summary of the U.S. government's total outstanding debt at the end of each fiscal year from 1789 to the current year. Between 1789 and 1842, the fiscal year began in January. From January 1842 until 1977, the fiscal year began in July.From July 1977 onwards, the fiscal year has started in October. Between 1789 and 1919, debt outstanding was presented as of the first day of the next fiscal year. From 1920 onwards, debt outstanding has been presented as of the final day of the fiscal year.There are six datasets on Fiscal Data which include the national debt, which is referred to as Total Public Debt Outstanding (TPDO). TPDO is the sum of Debt Held by the Public and Intragovernmental (Intragov) Holdings. Some datasets include debt issued by the Federal Financing Bank (FFB).

WASHINGTON (AP) — The U.S. government’s gross national debt has surpassed $37 trillion, a record number that highlights the accelerating debt on America’s balance sheet and increased cost pressures on taxpayers. The $37 trillion update is found in the latest Treasury Department report ...

WASHINGTON (AP) — The U.S. government’s gross national debt has surpassed $37 trillion, a record number that highlights the accelerating debt on America’s balance sheet and increased cost pressures on taxpayers. The $37 trillion update is found in the latest Treasury Department report issued Tuesday which logs the nation’s daily finances.The national debt eclipsed $37 trillion years sooner than pre-pandemic projections. The Congressional Budget Office’s January 2020 projections had gross federal debt eclipsing $37 trillion after fiscal year 2030. But the debt grew faster than expected because of a multi-year COVID-19 pandemic starting in 2020 that shut down much of the U.S.And now, more government spending has been approved after Trump signed into law Republicans’ tax cut and spending legislation earlier this year. The law set to add $4.1 trillion to the national debt over the next decade, according to Congressional Budget Office estimates.Chair and CEO of the Peter G. Peterson Foundation, Michael Peterson said in a statement that government borrowing puts upward pressure on interest rates, “adding costs for everyone and reducing private sector investment. Within the federal budget, the debt crowds out important priorities and creates a damaging cycle of more borrowing, more interest costs, and even more borrowing.”

What is the total national debt? What is the debt per person? See the latest numbers and learn more about the causes of our high and rising debt.

Today, deficits are caused mainly by predictable structural factors: our aging baby-boom generation, rising healthcare costs, higher interest rates, and a tax system that does not bring in enough money to pay for what the government has promised its citizens. Moving forward, it will be critical for America’s leaders to address our rising debt, and its structural factors, which are described below.The U.S. tax system does not generate enough revenues to cover the spending policymakers have enacted. This rapidly growing imbalance between revenues and spending leads to higher and higher annual deficits, resulting in mounting debt.Each business day, the U.S. Treasury Department reports the amount of debt outstanding at the end of the previous business day. Our formula uses that number, as well as debt projections from the Congressional Budget Office (CBO), to estimate the rate at which the debt is currently growing.The $37 trillion gross federal debt equals debt held by the public plus debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself.

The U.S. national debt is climbing at a rapid pace, on track to double over the next three decades amid a rush of spending by the White House and Congress.

The United States' national debt is on track to double over the next three decades amid a rush of spending by the White House and Congress.The unrelenting increase is what prompted Fitch Ratings to issue a surprise downgrade of the nation's long-term credit score in mid-2023. The agency cut the U.S. debt by one notch, snatching away its pristine AAA rating in exchange for an AA+ grade.In May, Moody's Ratings became the third of the three major ratings agencies to downgrade the U.S. credit rating from its highest tier, lowering it from Aaa to Aa1 on its 21-notch scale. The firm noted that the cost of interest payments on the debt is projected to rise from 9% of federal revenue to 30% of federal revenue by 2035.During Trump's first term, the national debt grew by about $7.5 trillion in part due to the onset of the COVID-19 pandemic, which prompted Congress and the administration to enact fiscal stimulus aimed at supporting American households and businesses amid the uncertainty.

Data TypesAll data is returned as a string, including nulls. Refer to the chart above for the intended data type of each field. ... U.S. Treasury Monthly Statement of the Public Debt (MSPD)

Debt to the Penny is the total debt of the U.S. government and is reported daily. It is made up of intragovernmental holdings and debt held by the public.The Debt to the Penny dataset provides information about the total outstanding public debt and is reported each day. Debt to the Penny is made up of intragovernmental holdings and debt held by the public, including securities issued by the U.S.Treasury. Total public debt outstanding is composed of Treasury Bills, Notes, Bonds, Treasury Inflation-Protected Securities (TIPS), Floating Rate Notes (FRNs), and Federal Financing Bank (FFB) securities, as well as Domestic Series, Foreign Series, State and Local Government Series (SLGS), U.S.There are six datasets on Fiscal Data which include the national debt, which is referred to as Total Public Debt Outstanding (TPDO). TPDO is the sum of Debt Held by the Public and Intragovernmental (Intragov) Holdings. Some datasets include debt issued by the Federal Financing Bank (FFB).

Charts · About · Announcements · Technical Q&As · Show More · Show More · The Board of Governors of the Federal Reserve System and the Federal Reserve Bank of St. Louis's Federal Reserve Economic Data (FRED) program are working together to expand options for finding, accessing, and ...

Charts · About · Announcements · Technical Q&As · Show More · Show More · The Board of Governors of the Federal Reserve System and the Federal Reserve Bank of St. Louis's Federal Reserve Economic Data (FRED) program are working together to expand options for finding, accessing, and visualizing data from the Board's Data Download Program (DDP) in FRED.

As of August 2025, of the $29.97 trillion of total public debt outstanding, $15.21 trillion (50.74 percent) is in notes, $6.37 trillion (21.25 percent) is in bills, and $5.09 trillion (16.97 percent) is in bonds.

As of September 04, 2025, total gross national debt is $37.43 trillion.Debt held by the public is $30.12 trillion.Intragovernmental debt is $7.31 trillion.Relative to one year ago, total gross national debt is $2.09 trillion higher; relative to five years ago, it is $10.73 trillion higher.